How To Get Credit For Paying Rent

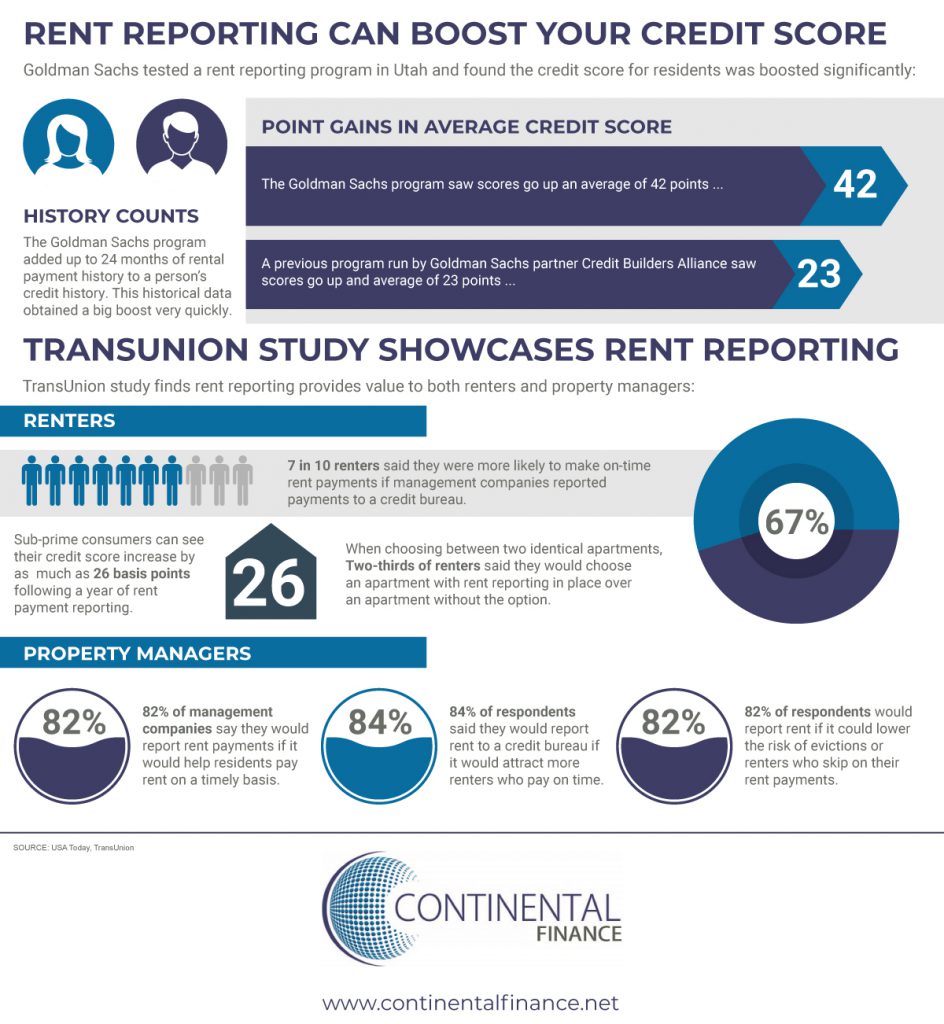

When it comes to determining your credit score the largest impact to your score is payment history.

How to get credit for paying rent. Some rent payment services tout the opportunity to earn incentives for paying rent with rewards credit cards but the cost of the processing fee can eliminate any reward earnings. If you have a. In terms of help with paying your rent the cares act provides the department of housing and urban development with an additional 17 4 billion in funding including monies for rent assistance. Do a bank wire transfer use a debit card write a paper check pay in cash pay with a money order.

A credit score can and does affect your situation when you want to rent an apartment. This one factor influences 35 of your score. Your rental payment information will be included as part of your standard credit report and may be incorporated into certain credit scores. Or you could use one of these methods.

Experian rentbureau collects rental payments for your credit report while transunion lists the information directly onto your credit report. How paying rent on time helps build your credit history experian incorporates on time rental payment data reported to experian rentbureau into experian credit reports. But rent reporting services can get your credit reports to reflect your rent payments fairly easily at a cost that ranges from free to more than 100 a year.

/how-to-rent-an-apartment-with-bad-credit-960969-v3-5b64bafa46e0fb0025430a5e.png)