How To Get Llc And Tax Id Number

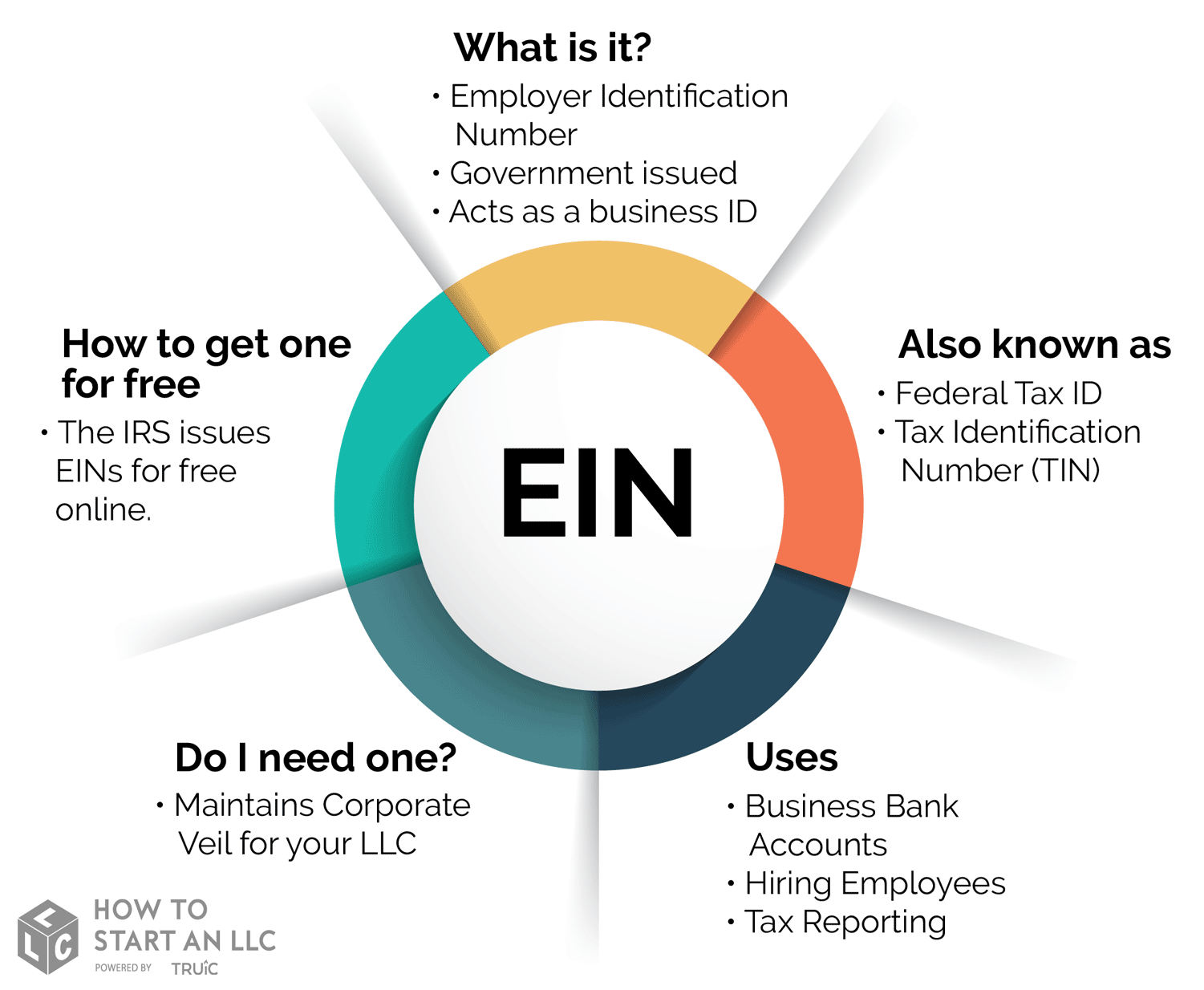

An llc must present the company s tax id number to establish a business bank account.

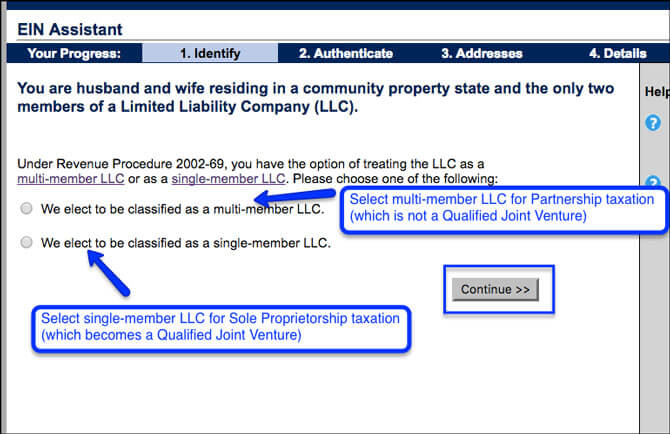

How to get llc and tax id number. All llc s that have 2 or more members are required to obtain a tax id ein. If you ve recently formed a limited liability company llc it is usually a good idea to apply promptly for a federal employer identification number ein from the u s. Govt assist llc only works on behalf of its clients and is in no way affiliated with any governmental or regulatory agency including the irs. Working with vendors certain vendors may not do business with an llc that does not have a tax id.

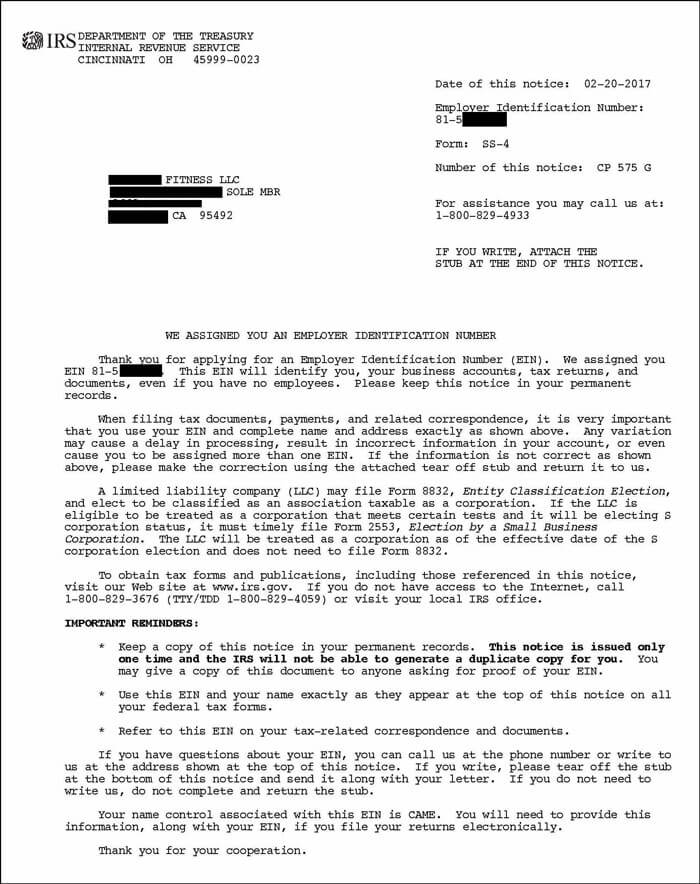

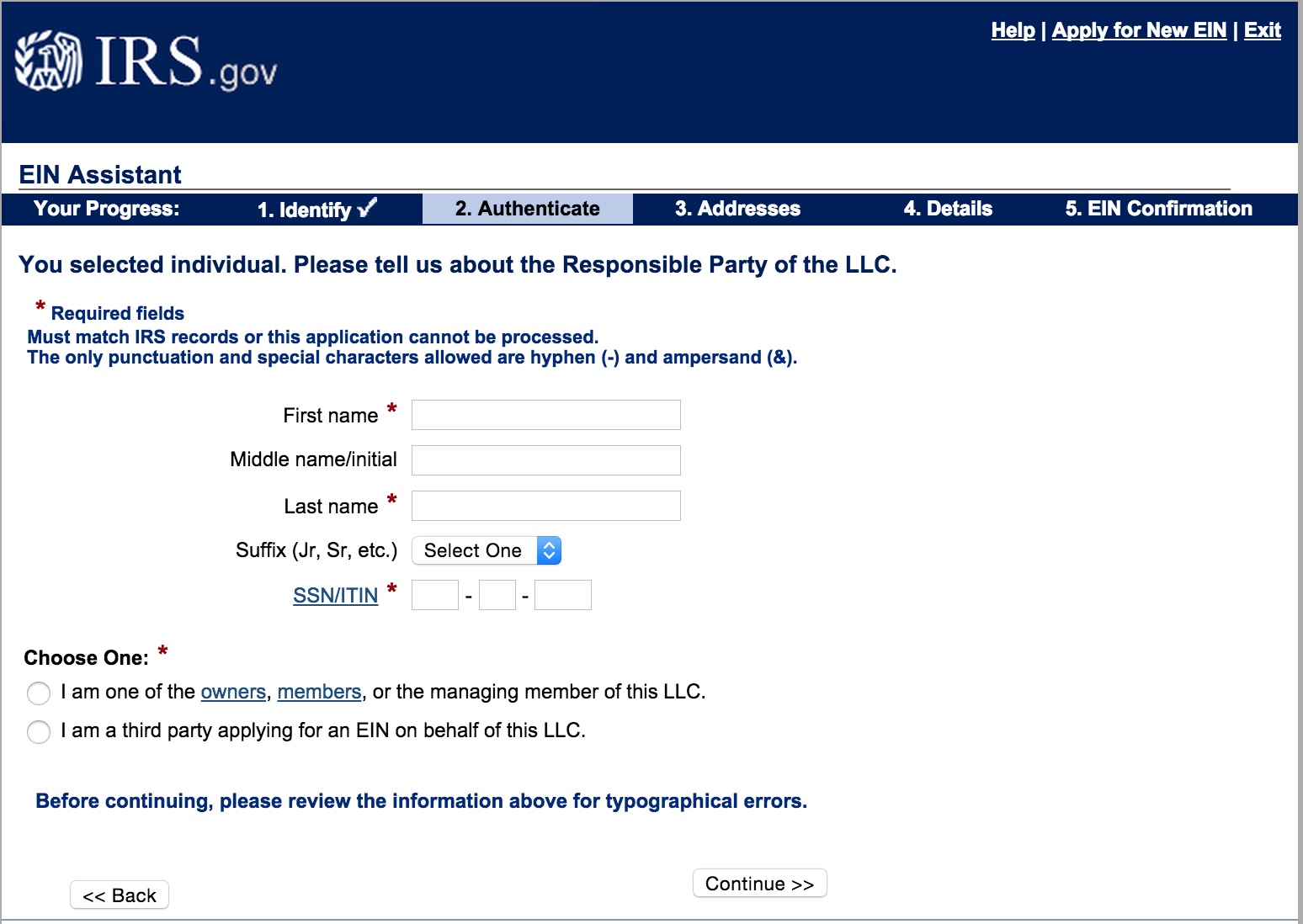

Internal revenue service irs. This is a free service offered by the internal revenue service and you can get your ein immediately. The responsible party is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Govt assist llc acts as a third party designee as described in the instructions to form ss 4 to help clients obtain federal tax id numbers from the internal revenue service the irs in a timely manner.

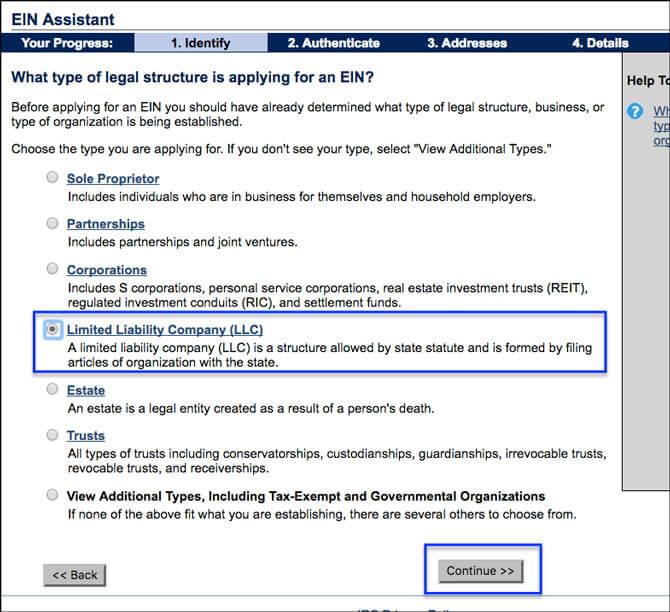

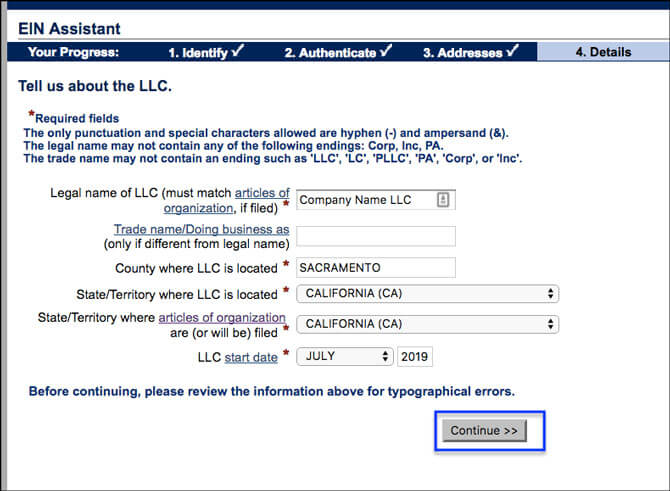

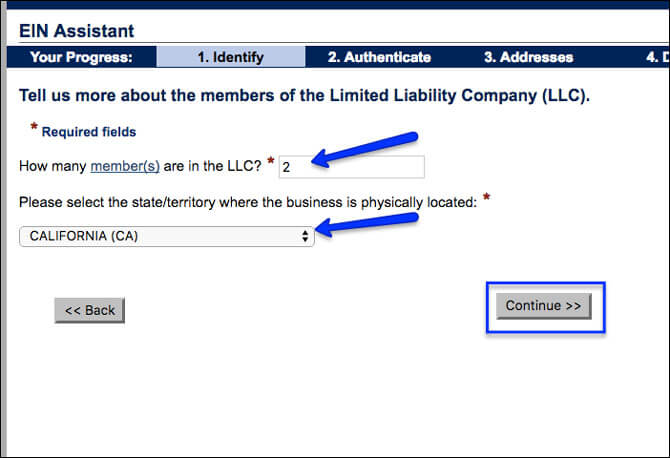

If the llc has 2 or more members. It is a 9 digit number beginning with the number 9 formatted like an ssn nnn nn nnnn. Llcs that sell items to the public are required. Apply for an ein with the irs assistance tool.

You may apply for an ein in various ways and now you may apply online. For example if a disregarded entity llc that is owned by an individual is required to provide a form w 9 request for taxpayer identification number tin and certification the w 9 should provide the owner s ssn or ein not the llc s ein. You are limited to one ein per responsible party per day. It will guide you through questions and ask for your name social security number address and your doing business as dba name.

An employer identification number ein is also known as a federal tax identification number and is used to identify a business entity. Legal info disclaimer. When forming a limited liability company llc you ll need to apply for a federal tax id number or employer identification number ein for tax purposes. Generally businesses need an ein.

An itin or individual taxpayer identification number is a tax processing number only available for certain nonresident and resident aliens their spouses and dependents who cannot get a social security number ssn. It s easy to obtain requiring nothing more than filling out a one page form.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)